how to lower property taxes in ohio

You can find this on the Hamilton. First if the owner is seeking a decrease in property value of more than 50000 the BOR will notify the local school district.

Indeed elderly and disabled Ohio residents may be able to reduce their property taxes through the homestead exemption.

. Wide range of floor coverings to view in our store. Make sure to review possible exemptions before taking property taxes at face value. In 2005 as part of a broader series of tax reforms the General.

Mortgage Relief Program is Giving 3708 Back to Homeowners. Later that year in 2007 it became apparent that General. Up to 25 cash back Method 2.

Check Your Eligibility Today. And if you want to skip the ongoing property taxes and sell your house. Plus since there are several ways your appeal can get thrown out and lots of heady math involved a tax attorney can help you figure out whether you have a caseand help.

First if the owner is seeking a decrease in property value of more than 50000 the BOR will notify the local school district. This is awarded as a rebate or tax credit that is intended to cover a. July 9 2022 - July 18 2022.

How to Lower Your Property Taxes in Ohio. Ad Homeowners Relief Program is Giving 3708 Back to HomeownersCheck Your Eligibility. Since 1971 a 10 percent reduction or rollback has ap plied to each taxpayers real property tax bill.

New Yorks senior exemption is also pretty generous. The exemption offers homeowners who are disabled or over 65 years old a reduction of. The exact property tax levied depends on the county in Ohio the property is located in.

Enroll in a Tax Relief Program. WHAT TO DO. The bills due next year technically.

Visit the Franklin County Auditors Site to check the current total assessed value of your home. 10 penalty on the. Its calculated at 50 percent of your homes appraised value meaning youre only paying half the usual taxes for your.

In order to lower your current property tax first evaluate your current property record card This is the official description of your house. Find All Tax Breaks to Which Youre Entitled. Delaware County collects the highest property tax in Ohio levying an average of 373200 148 of.

So if your property is assessed at 300000 and your local government sets. Essentially the homestead exemption allows eligible individuals to. 01988 402000 07766 951372.

Claim the homestead exemption if you are eligible. March 8 2022. 5 penalty on the total unpaid 2021 real estate tax.

Last year the Ohio General Assembly made changes to the Homestead Exemption which provides for annual property tax relief to Eligible Homeowners all homeowners 65 and older. Your state may also offer a tax relief program for low-income individuals. School districts generally receive between 65 percent to 70.

In addition to trying to reduce the taxable value of your home Ohio property tax law allows for reduced. Click Property Search search by name address or parcel. The exact time frame to begin filing appeals varies but all counties in Ohio must accept appeals through March for the tax bills due that year.

In order to come up with your tax bill your tax office multiplies the tax rate by the assessed value. Use our free Ohio property records tool to look up basic data about any property and calculate the approximate property tax due for that property based on the most recent assessment and. February 1 2018.

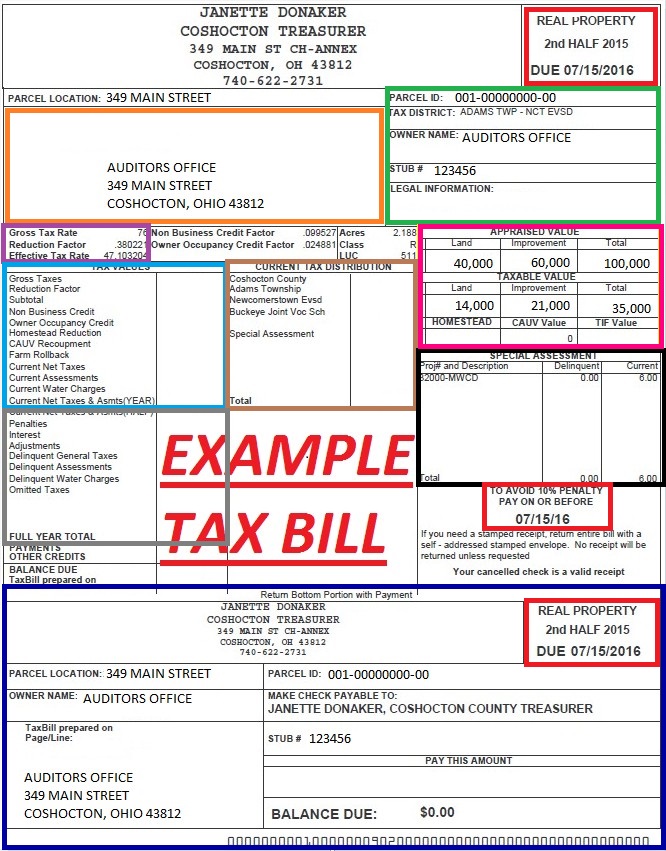

Tion provides a reduction in property taxes to qualifiedsenior or disabled citizens or a surviving spouse on the dwelling that is that individuals principal place of residence and up to one acre. 10 penalty on the unpaid current half tax. It is helpful to have your property tax bill handy for this explanation of general property tax information and how it relates to CAUV.

School districts generally receive between 65. Property tax rollbacks. A constitutional amendment allowing senior citizens to pay lower property taxes in Ohio was approved by voters in 1970.

Ohio Property Tax Calculator Smartasset

Ohio Property Tax Calculator Smartasset

Find Tax Help Cuyahoga County Department Of Consumer Affairs

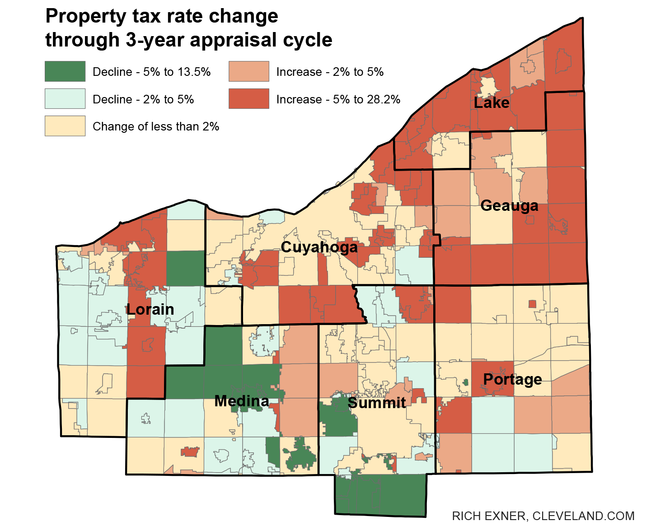

Compare New Property Tax Rates In Greater Cleveland Akron Part Of South Euclid Now Has Top Rate In Northeast Ohio Cleveland Com

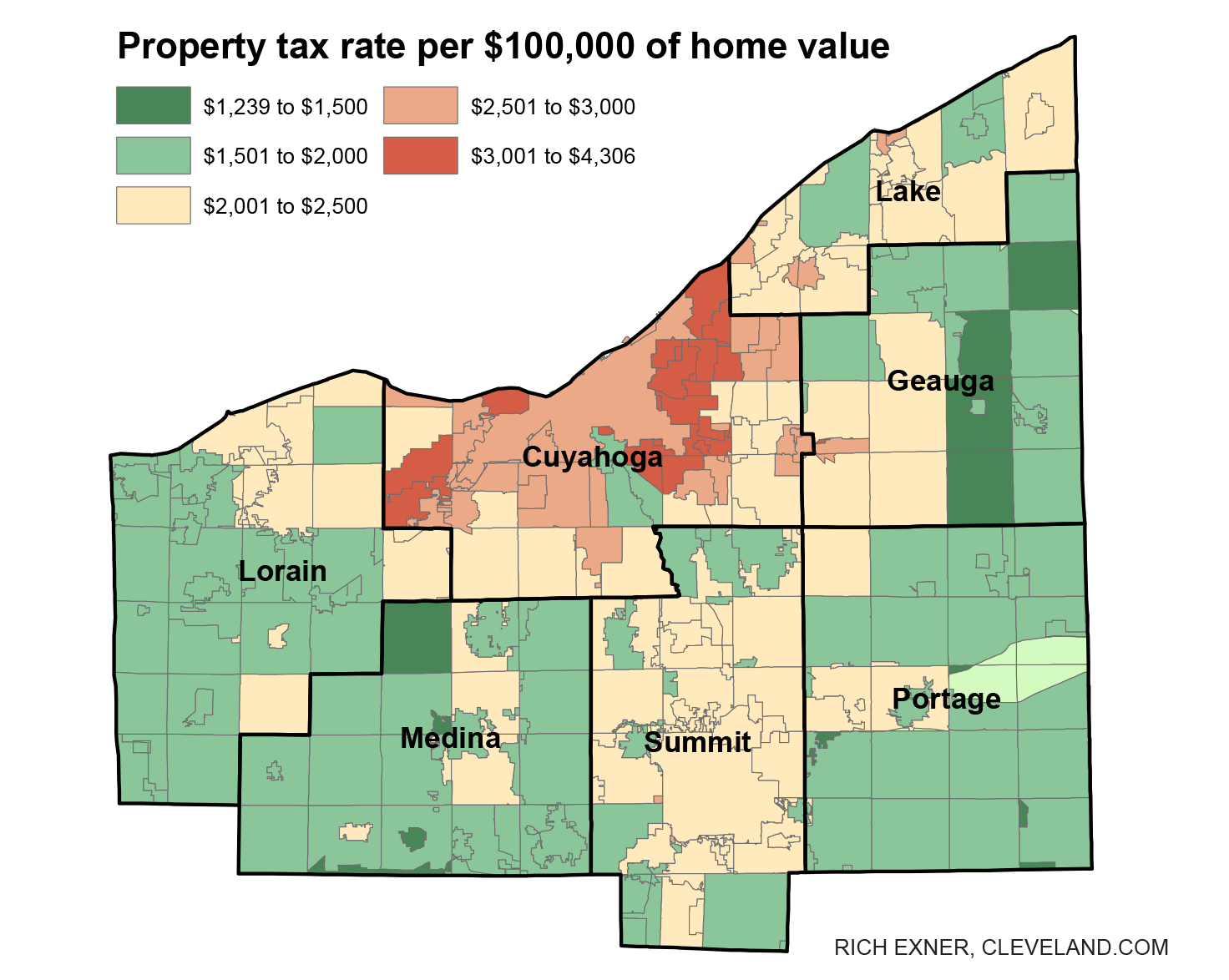

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

Compare New Property Tax Rates In Greater Cleveland Akron Part Of South Euclid Now Has Top Rate In Northeast Ohio Cleveland Com

Distributions Real Property Tax Rollbacks Overview Department Of Taxation

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

Property Tax Rates High In Ohio And Cincinnati Area

Understanding Your Tax Bill Coshocton County Auditor

Pay Property Taxes Online County Of Columbiana Papergov

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

Property Taxes By State County Lowest Property Taxes In The Us Mapped

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

States With Highest And Lowest Sales Tax Rates

Real Property Tax Homestead Means Testing Department Of Taxation

Spotlight On Ohio Local Taxes Local Taxes Local Tax Compliance

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com